nuclear subsidies

Nuclear Power as Taxpayer Patronage: A Case Study of Subsidies to Calvert Cliffs Unit 3

A case study of the proposed new reactor at Calvert Cliffs in Lusby, MD provides a useful window into the dynamics and implications of federal nuclear policy today. The analysis demonstrates not only that the taxpayer ends up as the largest de facto investor in this project, but also that while we bear most of the downside risk, we share little of the upside should the plant ultimately be successful.

Brave New Nuclear World

The review of plant economics and subsidies (and therefore the references to Earth Track's work on nuclear subsidies) was included in the first part of this article. Part 1 is accessible here; the second part, addressing reliability and energy security issues can be found here.

Excerpt from Part 1 below:

Nuclear Power Surge Coming

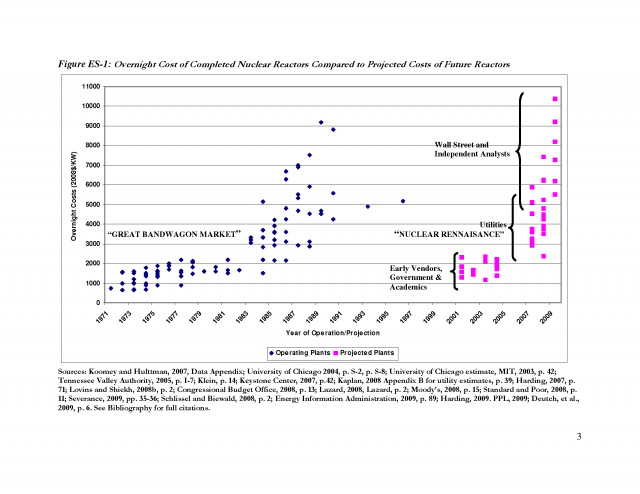

With this week's application to build a new nuclear plant – the first such filing in nearly 30 years – the industry says the US is on the verge of a nuclear power renaissance.

With virtually no greenhouse-gas emissions, reactors are touted as part of the solution to global warming. Over the next 15 months, the Nuclear Regulatory Commission expects a tidal wave of similar permit applications for up to 28 new reactors, costing up to $90 billion to build.

But the renaissance may be less robust than it looks...

Nuclear Power Primed for Comback: Demand, Subsidies Spur US Utilities

"To ease financial concerns, the nuclear power industry has turned to Congress. Among the biggest reasons for renewed interest in nuclear power are the tax breaks, loan guarantees and other subsidies in the Energy Policy Act of 2005.

Those benefits were "the whole reason we started down this path," Crane said after filing NRG Energy's license application. "If it were not for the nuclear provisions in there, we would not have even started developing this plan two years ago."

NuSubsidies Nuclear Consortium

Learn about the power of Policy-Enhanced Investing to turn nuclear power from the dog of Wall Street into the mightily-hyped favored solution for all of the US' energy woes in this tongue-and-cheek strategic review of the industry.