For years Armin Wagner and his team have toiled to pull together a consistent set of motor fuel prices from around the world. Though the work may not get the attention showered each year on the the Economist's "Big Mac" index, the GTZ analysis in my mind is far more important.

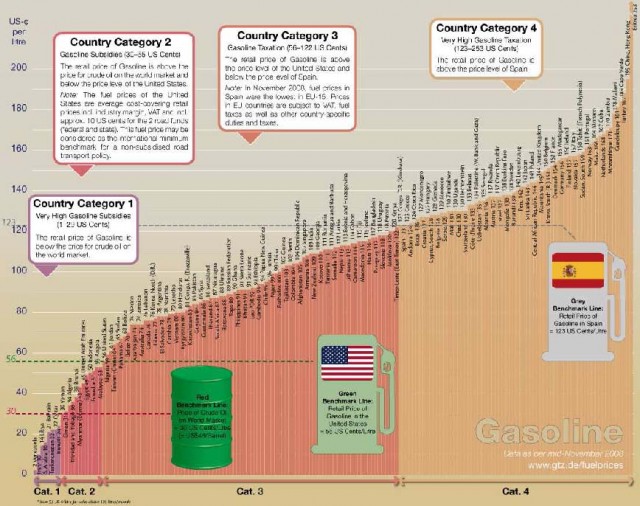

GTZ tracks what is essentially a standard product around the world: gasoline and diesel vehicle fuel. Yet, the range in prices for fuel consumers varies enormously across countries, spanning three orders of magnitude. The chart below, covering 2008 data on gasoline, illustrates this striking span. A link to a higher resolution version helps with readability and provides a similar display for diesel.

Retail prices for gasoline, by country, 2008

Yes, there are a few (somewhat) logical explanations for portions of this variation. Remote countries pay more for transport and see higher prices. Large oil producing nations such as Venezuela and Iran use domestic subsidies to fuel to buy off the domestic population in a fossil-fuel variant of "bread and circuses." Some European nations use high petrol taxes to fund a variety of non-oil related activities. Other nations see very high prices due to corrupt central governments combined with inadequate domestic oil supplies or refining capacity or access to imports.

But these explanations only go so far. Note how close to the bottom of the spectrum the United States is. Efficient markets? Taxes only high enough to cover activities supporting petroleum-related issues such as leaking underground tanks and financing the roads on which these vehicles drive? My general impression had been that at least in terms of the US highway system, users more or less paid their cost through fuel excise taxes. There were clearly cross-subsidies (normally to heavy trucks) and a variety of other subsidies directly to oil, but at least the cost of roads was being picked up.

Turns out that this is not even close to being true. A detailed evaluation of federal transport subsidies recently released by the Pew Subsidyscope project (disclosure -- I'm on the project's advisory board) found that fees on road users, including fees on fuels, vehicle registration fees, and tolls covered only 51 percent of the nearly $200 billion the US spent on highway construction and maintenance in 2007 -- the lowest contribution from users since the interstate highway system began in 1957. The rest of the funds came from non-user funding sources, such as general tax revenue and bonds (often subsidized tax-exempt bonds).

Pew rightly points out that some motor fuel excise fees are directed to non-road uses, such as mass transit. However, even if all of these fees are also credited to roadways, the user-fee share rises only to 65 percent -- still dumping more than a third of costs onto others. And it is useful to note that the Pew analysis doesn't pick up everything. State, county, and local roads are major expenditure items for most of sub-national governments, and not generally funded by user fees. Even National Forests make payments in lieu of property taxes to state governments; federal roads to my knowledge do not.

Yet even ignoring these other subsidies, the Pew results are striking in an era where countries are meeting to address options to curb carbon emissions. Road transport is not only a significant source of greenhouse gas emissions in the US, but it is the country's primary energy security challenge. Continued subsidization of the fuels directly, or the instrastructure that drives that consumption, makes little sense.

If we charged motor fuel excise taxes high enough to cover the cost of building and maintaining our roads (levied not only on petrol fuels, but ethanol and other transport fuels as well), US pump prices would be much closer to those in some European countries. And while raising fuel taxes is considered the "third rail" of US politics (touch the issue and you will die politically), the Pew analysis demonstrates that the issue is not really about raising fuel taxes at all. It is about removing subsidies.