The Inter-American Development Bank (IDB) is embarking on a major work program to identify and assess fossil fuel subsidies throughout Latin America and the Carribean. I had the privilege of presenting a number of ideas on how to leverage their effort during an expert meeting on the topic a few weeks back. The slides from my presentation can be viewed here.

Growing consensus that fossil fuel subsidies need to go

IDB joins a growing array of global institutions that have recognized the importance of finally addressing large and pervasive subsidies to oil, coal, and natural gas. The list includes the World Bank, OECD, IMF, IEA, UN, G-20, and many national governments, including even a growing number of OPEC members. The degree of attention, including at the top levels of many governments, was unimaginable 25 years ago when I started working on the issue.

Even recognizing that political attention is but first step of a much more difficult process of reform, this is still an exremely positive trend. It is progress that data series (such as IEA's price gap figures) are being developed annually rather than intermittently, and for a growing number of countries. It is progress that the types of market interventions being measured and tracked are slowly expanding to include policy instruments on the producer side (work undertaken most broadly by OECD). And it is progress that these organizations are starting to talk to each other on a regular basis to more effectively leverage the limited funding available to track the subsidy programs.

Why now? Partly it's about the money: well over half a trillion dollars per year goes to subsidize fossil fuels around the world, and with at least as much in associated damage to environmental quality and human health. The expenditures are stressing many governments, and even though some of the subsidies aim to help the poor obtain access to energy services, it is well recognized that there are more efficient pathways to do so. Partly it's about the environmental impacts: subsidy elimination is a no-brainer if one wants to deal with bringing down greenhouse gas emissions. It hardly makes sense to institute a carbon tax while you are subsidizing the exact same fuels a the same time. And partly there is an internal momentum that builds once enough organizations have put an issue on their agenda and other groups pick up the discussion as well.

Recommendations to leverage IADB's work

The areas covered in my presentation included:

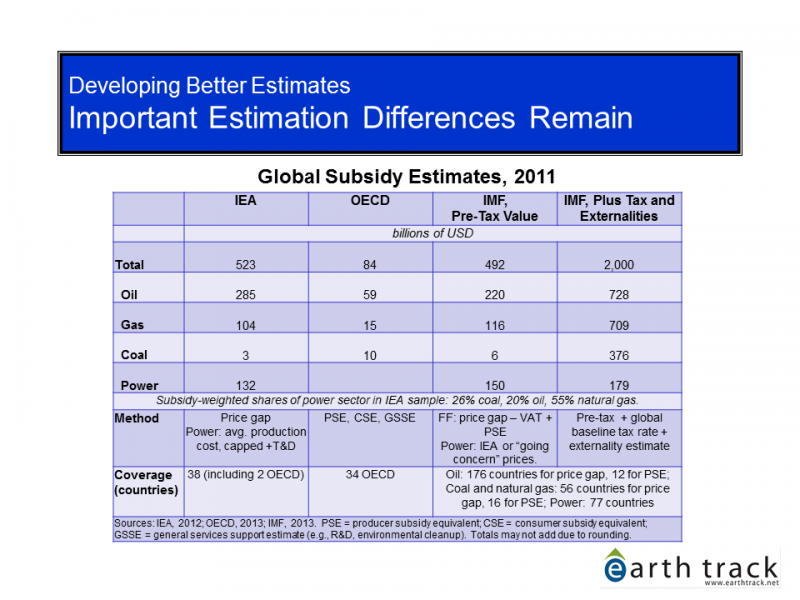

- Understanding why global subsidy estimates reported by OECD, IMF, and IEA differ from each other (see Slide 1 below), and what subsidy types nobody is tracking.

- Taking steps to ensure that work is coordinated across the international organizations, such that methodologies are consistent (so results can be more easily combined) and key unanswered questions are divided up amongst them to avoid duplication.

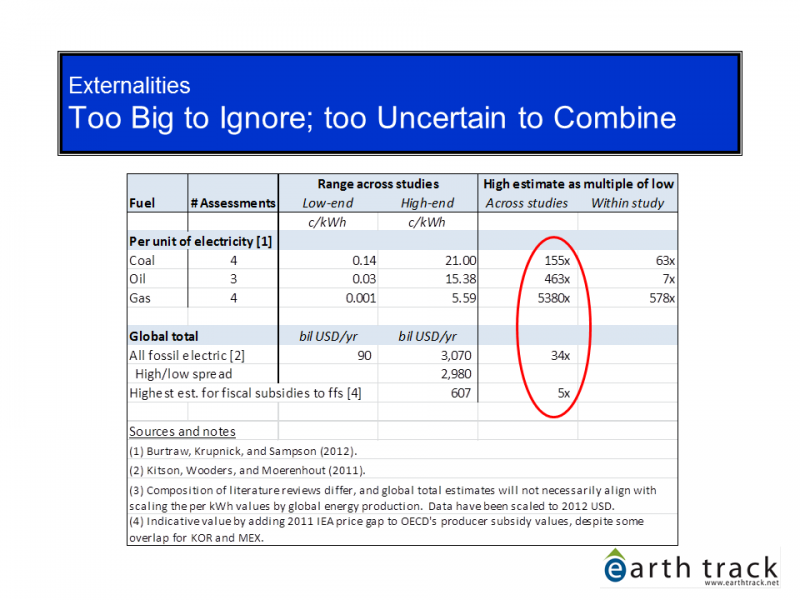

- Separating environmental externalities from fiscal subsidies in the presentation of data on government support. The wide variance in externality estimates (see Slide 2 below), along with some methodological issues in what specific external costs are being attributed to fossil fuels (as opposed to vehicles, or roads, or congestion), both contribute to this recommendation.

- Supplementing price gap data with critical case studies of energy market distortions in the Latin America and Carribean region (LAC). Expanding price gap coverage is useful, but it is not sufficient to properly map subsidies in the LAC region or the political impediments to reform. Recommended case studies include examining subsidies to bulk energy transport and how those policies can undermine market entry points for distributed energy; and evaluating in detail the multi-layered subsidies to government-owned energy enterprises (such as in Mexico and Brazil), even if the fuels they produce are sold at world prices (and therefore would not show up as subsidized using the price gap approach).

Slide 1

Slide 2