How frustrating to be on the verge of a nuclear renaissance, with only that little problem of economic viability getting in the way. To listen to industry advocate Matthew Bennett at Third Way describe it, the economics problem is merely the "last straw" of for nuclear opponents who have lost all of their other arguments challenging a major new wave of (assumedly publicly-financed) nuclear reactors. (More analysis of this very important story on nuclear loan guarantees by Peter Behr coming soon).

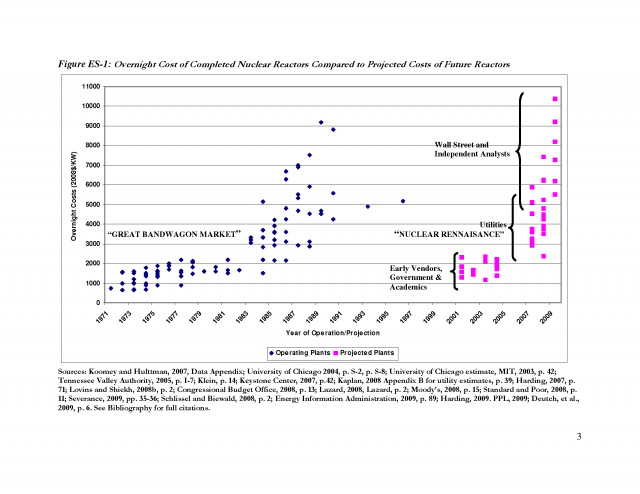

As straws go, this one seems to be a veritable hay field, and one that has been around a very long time. The best chart I've seen making sense of the slew of ever-changing nuclear plant cost estimates was assembled by Mark Cooper at the Vermont Law School, and published in June. Not only does it track costs on a consistent basis over almost 40 years of reactor construction, but it also groups the values by the type of entity making the estimate. Lo and behold, it is not the granola crunching, rarely bathing, reactor hating enviros who have been generating the most problematic plant cost estimates. No, it has been those hard nosed bankers and ratings agencies. Early estimates by vendors, academic institutions with nuclear engineering programs, and government agencies affiliated with nuclear power tended to have the most optimistic projections.

But this is not the end of the story. Moody's Investors Service put out an updated note on new build reactors that same month. More sordid history, with a complete inventory of credit rating downgrades during the last waves of plant construction. The vast majority of projects moved their sponsors down the credit rating scale; in one case by as many as 12 notches. Many of the downgrades lasted a decade or longer. Moody's notes that

We view new nuclear generation plans as a "bet the farm" endeavor for most companies, due to the size of the investment and length of time needed to build a nuclear power facility. While we continue to view operating nuclear units positively, we increasingly sense that none of the issuers actively pursuing these endeavors have taken any material actions to strengthen their balance sheets. As a result, it has become increasingly likely that the pursuit of new nuclear power projects will lead to some near-term rating actions or outlook changes.

If they are serious about new reactors, how could the utilities not be bolstering their balance sheets to handle the hit? The simple answer is that they are all looking to the government to be their silent partner on these projects. Why bring in more expensive joint ventures, equity finance, and risk syndication through long-term insurance or power sale agreements if you can get the government to do it nearly for free? This approach, which I refer to as PEI, or Policy-Enhanced Investing, is a global phenomenon. It is also prevalent not just in the reactor segment of the nuclear fuel chain, but in waste management, liability insurance and enrichment as well.

Just last week, Citigroup Global Markets (New Nuclear - The Economics Say No) piled on as well, taking a similarly negative view on the inherent feasibility of new reactors:

Government policy remains that the private sector takes full exposure to the three main risks: Construction, Power Price, and Operation. Nowhere in the world have nuclear power stations been built on this basis...Nor will they be built in the UK.

Citigroup modeled power prices since 2000 against expected performance of new nuclear power stations and found that "they would have only generated a competitive return to equity investors for a period of only 20 months in the last 115." This is hardly reassuring for an asset with an expected life of 480 to 720 months. Citi defines "competitive" in this case as 100 bps (10%) above the cost of capital. Given the many risks involved, this return threshold may actually be too low to bring forth the capital.

So maybe the economics really are an issue to grapple with, not mere straws. And if competing power sources must manage their construction, price, and operating risks without massive government subsidy -- and they are cheaper even in a carbon-constrained world, the case for layer upon layer of subsidy to new build nuclear seems quite baseless.