Following the general approach used for Kentucky, researchers from Downstream Strategies and the West Virginia Center on Budget and Policy have canvassed detailed budget materials for both Tennessee and West Virginia to estimate the net budgetary effects of coal mining within the states in two new reports. (Thanks to Amy Larkin of Greenpeace for the heads-up on their work).

This is not an easy task. State governments often have lower levels of transparency than the federal government, especially with respect to less direct support mechanisms such as tax expenditures, credit or insurance support, or legacy costs. The information may be in less accessible or standardized forms than federal datasets, making local knowledge and relationships important. There may be interactions between state-level policy with federal or local programs. Authors Rory McIlmoil, Evan Hansen, Ted Boettner, and Paul Miller have done a nice job.

As with the Kentucky analysis (different authors), the reports illustrate that state-level policies are material with regards to natural resource subsidies. While coal mining does support local jobs and generate some direct tax revenue to state coffers, both TN and WV appear to run net deficits on their coal industries. Just as industry has a "cost of goods sold," so too do states or other government entities. Without careful evaluation of what those costs are, it is impossible to evaluate what types of policies make sense. While a net deficit doesn't mean states should disinvest from any particular industry, it should make citizens question more closely the strategic evolution of state industry. Are subsidies to old industries undermining the development of new ones? Have state agencies properly integrated new options (better roads, telecommunications links) that didn't exist decades ago in assessing options for rural development going forward?

Among the important findings I saw in these papers:

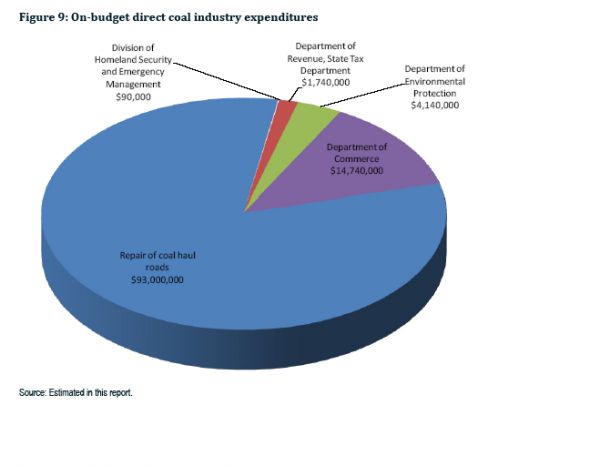

1) Damage to roads and bridges from heavy coal trucks is an oft-overlooked cost of production, but overwhelms most of the direct administrative costs of coal-related state agencies. The chart below illustrates this point quite well in relation to West Virginia. In WV, the majority of coal-related permits are for the heaviest truck category (roughly up to 126,000 pounds with the 5% allowable exceedance), damages can be substantial. The authors note that a 120,000 pound truck will generate more than 4x the amount of strain on a roadway than the next highest category of vehicle at 80,000 pounds. (As an aside, underpayment by heavy trucks for road use is a generic problem on national highways. Road subsidies in general are a significant source of subsidy to timber extraction as well.)

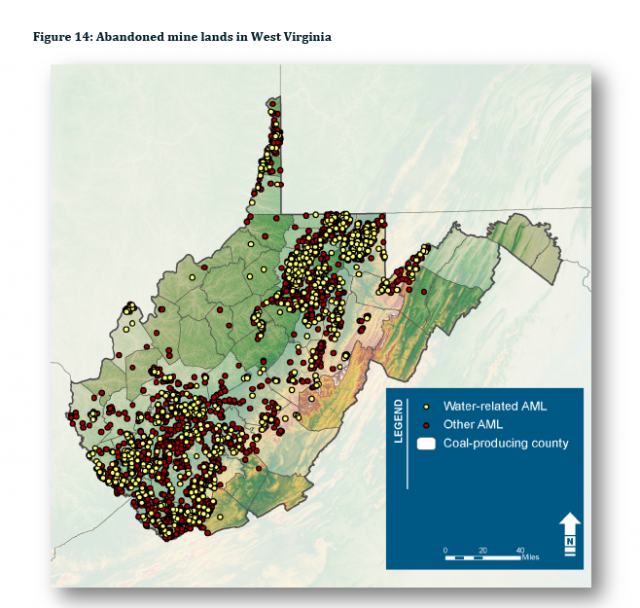

2) Both states have significant, underfunded, abandoned mine land problems. As shown below for WV, the state is riddled with AMLs. For both states, total expenditures on reclamation to-date are well below the expected cost of remaining sites to be addressed.

3) Job creation and regional impact models need to be taken with caution. The authors concur with earlier caveats from the Kentucky coal analysis on regional multiplier models in reference to natural resources, which they quote in their document:

“The RIMS II, and all economic impact multipliers, is surrounded by criticism of the models based on the assumptions built into the models and the resulting limits of their applicability and accuracy. The model assumes that all direct, indirect and induced effects would not otherwise occur without the project. The absence of the counterfactual—meaning we really have no way of knowing or modeling what activities would occur without the project—is problematic. The base assumption of the RIMS II (and all multiplier models), that it places all other economic activity on hold is significant and presents obvious problems under the best circumstances. In addition to these concerns, the application of this method to an industry that has been in the region for more than 100 years and is tied to a place-specific natural resource violates basic principles of a model designed to assess the impact of economic shocks such as development projects or firm closures.” (Konty and Bailey, 2010, p. 20)

The authors further note that "[d]espite these potential pitfalls, multipliers are often used by the industry itself and by researchers to estimate an industry’s indirect impacts. We perform these calculations with a recognition that, while imperfect, these multipliers allow us to clarify key issues and to perform initial, if imprecise, calculations." These caveats apply equally well to many of the jobs claims perpetually circulated by the ethanol industry.