Lots of action on the biofuels front to talk about: VEETC near death? Corn wiggling its way into advanced ethanol and biodiesel mandates. E15 gets a cool new warning label, but auto makers steer clear.

1) Death of VEETC?

A group of Senators has introduced legislation to kill the ethanol blenders credit and the import tariff some months before they are intended to expire anyway. The payoff to the industry for going along: nearly $700 million of the savings applied to extend the small producer production tax credit and tax breaks for blender pumps. Not a perfect bill, but given that the excise tax credit may not really be allowed to die in December this year as planned (DC insiders were sure it would die last year too), perhaps the bill is a reasonable trade-off for certainty. The tax breaks for refueling equipment are not limited to ethanol blender pumps, though are likely to favor them given not much else in the way of alternative fuels is flowing into gas stations at the moment. If other infrastructure starts tapping into these breaks (electric vehicle recharging stations, for example), I'd expect the tax losses to Treasury to rise.

Thankfully the bill does not provide subsidies to an ethanol pipeline, something that would increase the barriers to entry for better substitute fuels. And, while the demise of VEETC would have deficit reduction benefits, as I've noted in earlier posts the subsidy to the biofuel industry will remain -- albeit in the form of higher fuel prices due to consumption mandates rather than the tax credits.

The Wall Street Journal characterizes the payoffs to the ethanol industry this way:

Their obvious political calculation is that the $668 million gratuity the Senators felt they owed this ward of the state will become as inviolable as the tariff and blenders credit were until now, and grow over time. We'll take this offering to St. Jude, the patron saint of lost causes we've invoked for over 30 years in opposition to ethanol. We hope it's a down payment on a non-insane U.S. energy policy.

If only the Journal would take an equally hard-line on massive subsidies to nuclear energy; St. Jude isn't just visiting ethanol plants.

2) So "Advanced" biofuels is still really just corn?

Since producing ethanol from corn is a stable technology, justification for billions in subsidies to corn ethanol has often rested on claims that this work is a necessary stepping-stone from what we know to more complex, advanced biofuels. Here is MIT researcher Tiffany Groode back in 2007:

I view corn-based ethanol as a stepping-stone. People can buy flexible-fuel vehicles right now and get used to the idea that ethanol or E85 works in their car. If ethanol is produced from a more environmentally friendly source in the future, we'll be ready for it.

Corn ethanol did fill most of the 10% ethanol capacity in existing fleets, turning into a bit more of the proverbial millstone than a stepping stone. More expensive cellulosic fuels will have an even more difficult time trying to enter the market as a result. But there is also growing evidence that these "advanced" fuels may be in large part corn as well.

Corn for Cellulosic Production

DOE's first loan guarantee for "advanced" biofuels was announced last week. It provides $105 million in support for the nation's first commercial scale cellulosic plant. It's backer, POET, has patriotically named the plant "Project Liberty" because it will supposedly free us from the shackles of foreign oil. The firm calls the plant "pioneering." Indeed, DOE notes that "Unlike many conventional corn ethanol plants, Project LIBERTY will use corncobs, leaves and husks..." So much for breaking the corn cycle: the subsidies will merely increase the returns to converting corn crops in their entirety into fuel.

An interesting recent paper by Juan Sesmero at Purdue notes that corn stove is expected to meet 25% of the advanced biofuels mandate under USDA and EPA projections. Further, he notes that the short-term economic returns on stover harvest (see page 18) for fuel quickly create pressure to harvest stover at rates as high as 80% of available biomass, well above the 30% sustainable yield rate.

Corn for Biodiesel Production

What about the biodiesel side? Biodiesel has a carve-out in the Renewable Fuels Standard to ensure that producers survive with an otherwise uneconomic product. An interesting article in Biodiesel Magazine indicates that corn is also playing an increasingly big role in tapping into biodiesel subsidies. Long-time industry journalist Ron Kotrba notes that in 2010, roughly 10% of the biodiesel mandate was filled by corn oil. 35% of ethanol producers already extract corn oil in their processes, a figure expected to double in the next couple of years. Some of the oil appears to be inedible (thereby not competing with other uses), though the article also notes that oil production can degrade the feed quality of dried distillers grains. This means there are clearly some fuel versus food (or at least feed) interactions here.

David Winsness, representing one of the firms developing oil extraction solutions, expected to see corn oil from ethanol fill 680 million gallons of the 1.28 billion mandate in 2013. This would mean king corn will comprise more than 50% of the biodiesel mandate as well. More subsidies to corn; and a high enough rate of biodiesel subsidy capture by corn to call into question the very purpose of having a segregated mandate for biodiesel at all.

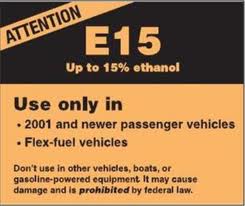

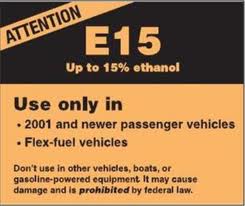

3) Caveat Emptor on E15: Use it incorrectly and void your auto warranty

Try to fill up your gasoline car with diesel fuel by accident and the pump won't fit into the hole of your gas tank. After a bit of fidgeting and head scratching, most people will determine their error and go to the right pumps. Not so clear with E15, the ethanol industry's short-term salvation for building too much subsidized production capacity for what the existing vehicle fleet can absorb. Here, we've got a new, EPA-approved warning label.  It is orange, and it does say "ATTENTION" in all capital letters -- an indication to look and listen. But let's say E15 looks cheaper (at least on a volumetric basis), or you don't speak English well, or you are in a rush. How many of you have put lower octane fuel in your vehicles that clearly say 91 or higher to save money, assuming it won't make much of a difference if you do it once in awhile?

It is orange, and it does say "ATTENTION" in all capital letters -- an indication to look and listen. But let's say E15 looks cheaper (at least on a volumetric basis), or you don't speak English well, or you are in a rush. How many of you have put lower octane fuel in your vehicles that clearly say 91 or higher to save money, assuming it won't make much of a difference if you do it once in awhile?

With E15, filling improperly might make a difference. All of the major auto makers have stated that using E15 in the wrong vehicle will void your warranty. As Consumer Reports notes, most of these older vehicles are out of warranty anyway. However, there are concerns about how the higher blend might affect new cars still under warranty; and for owners on the impact of the higher blend on maintenance and repair costs. The National Petrochemical and Refiners Association is concerned about performance problems of the higher blends if they are used improperly small engines, boats, or snowmobiles resulting in engine damage or stranding. NPRA also notes that the ethanol industry has refused to warranty against engine damage of any type from the higher blends. This is perhaps an indication that they are less sure than their press releases that E15 use will be trouble-free. Further, retailers may be liable for a variety of problems associated with E15, including potentially higher air emissions than allowed (E10 gets some waivers that may be insufficient for E15). This, in addition to the conversion costs at gas stations for a limited market and higher customer confusion, may ultimately be what curbs the ethanol industry's push to have us all use more of their product whether we want to or not.

It is orange, and it does say "ATTENTION" in all capital letters -- an indication to look and listen. But let's say E15 looks cheaper (at least on a volumetric basis), or you don't speak English well, or you are in a rush. How many of you have put lower octane fuel in your vehicles that clearly say 91 or higher to save money, assuming it won't make much of a difference if you do it once in awhile?

It is orange, and it does say "ATTENTION" in all capital letters -- an indication to look and listen. But let's say E15 looks cheaper (at least on a volumetric basis), or you don't speak English well, or you are in a rush. How many of you have put lower octane fuel in your vehicles that clearly say 91 or higher to save money, assuming it won't make much of a difference if you do it once in awhile?