Defenders of Title 17 energy loan guarantee programs periodically point to the many other areas of the economy in which the government makes direct loans or guarantees. They use the other programs as evidence for two main points: that the government is experienced and skilled in leveraging public credit to support private activities; and that what is being attempted in the energy sector is no different from what lots of other industries already get. A recent commentary by Mark Muro and Jonathan Rothwell on the Brookings Institution web site makes this argument, pointing out that

The U.S. government runs some 70 loan guarantee programs and 63 lending programs that catalyze the financing of everything from transportation infrastructure and rural housing to science parks. More than $3 trillion of taxpayer money is at risk in these programs...

It is true that like all of these other programs, the energy credit support boosts the available financing for targeted projects. However, Title 17 is by no means comparable to a college loan, farm mortgage, or even the majority of export credits.

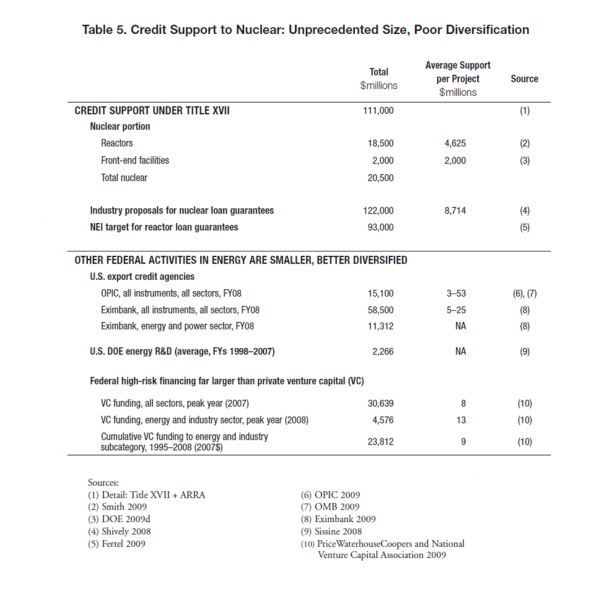

- Scale. The Solyndra guarantee was for more than $500 million; most of the DOE guarantees are in the hundred million dollar range or above. Those for nuclear power range from $2 to $8 billion in credit exposure for a single project. This is dramatically different from other programs. Average credit supports for OPIC and Eximbank, for example, are generally well below $50 million per project. Average venture capital investments in the energy sector were also much smaller, generally less than $10 million per round. Table 5 (below), excerpted from a detailed review I did of subsidies to nuclear power earlier this year, provides more resolution comparative scales.

- Technology risk. All federal lending programs face some risks of default, due to changing markets or economic conditions of the borrower. However, the energy credit programs also face a tremendous amount of technology risk. The instruments are priced as though they were run-of-the-mill projects being financed. In reality, however, the unproven technologies make them more akin to venture capital than to a standard project finance loan.

- Concentration of risk. As the scale of credit risk for individual deals rises, the impact of single defaults on the overall portfolio performance become increasingly important. Title 17 offers far less ability to use a mixed portfolio of commitments (e.g., a diversified mix of geographic locations or industry types) to offset the risks associated with single loans than exists for other programs (OPIC for example) that have a larger number of smaller scale, more diversified lending commitments. Furthermore, many of the supported projects face large systemic risks from events beyond their control. Chinese subsidies to solar put at risk many of the supported solar projects. Natural gas fracking (driving power prices down) and the Fukushima accident (driving nuclear power prices up) put at risk the ability for any of the proposed nuclear projects to be competitive.

- Poor transparency. Very little is known about the terms of the deals being struck, how loan guarantee "winners" are being selected by the small number of people involved in decision making, and potential conflicts of interest. How closely do the number of actual jobs created by a guaranee match the job creation claims on the application? On what basis was the credit subsidy on the loan calculated? Does the federal government have an equity participation should the high-risk investment pay off? Do any of the specialists involved in vetting the loan guarantees or the credit risk have conflicts that would bias their input? Surely there are ways to make much more information known to the public without revealing confidential business information. The Solyndra bankruptcy will hopefully lead us in that direction.

Finally, Muro and Rothwell suggest that despite the bankruptcy, there is a possibility that the taxpayer will be made whole. They underscore this point by reporting an asset value for the firm that exceeds the loan guarantee amount. Yes, the feds may get something. But we need to be realistic here: if liabilities didn't exceed assets, the firm wouldn't have declared bankruptcy. This means that the total debts of the firm go well beyond the federal loan guarantee that is attracting so much attention; and that the federal government is not the only creditor. Taxpayers will share in whatever is left on an equal basis (pari passu) with other creditors of a similar rank in the bankruptcy; original proposals to give DOE first access to assets in a bankruptcy were eliminated as the proposed rules for the program went final. Further, pre-bankruptcy asset values are often steeply discounted once the firm ceases to be a going concern, likely reducing recoveries still further.

Source: Doug Koplow, Earth Track, Inc. Nuclear Power: Still Not Viable Without Subsidies, (Washington, DC: Union of Concerned Scientists), 2011.