For years, the International Energy Agency has been measuring subsidies to consumers by looking at the gap between world reference prices for a particular form of energy and what that energy sells for in a country's domestic market. The lower the cost to consumers relative to its world value, the higher the subsidy. Russia has always been among the top of this list: in the IEA's 2010 update, Russia came in third with just under $40 billion in consumer subsidies.

Calculating consumer subsidies is not an easy task -- but it is downright simple compared to trying to figure out the many ways that a country lacking transparent fiscal systems subsidizes producers. There are assorted tax breaks, but also production-sharing agreements, tremendous government ownership of energy-related assets and infrastructure, and complicated financing schemes by which credit is channeled to those and other projects. Like China, the energy sector in Russia is very much a strategic asset of the government, and an extremely important one at that. It is quite difficult to figure out precisely how this relationship plays out in terms of altering market relationships and prices.

Dr. Ivetta Gerasimchuk, working with WWF-Russia and IISD's Global Subsidies Initiative, has done an admirable and detailed review of this arena in her recent study Fossil Fuels – At What Cost? Government support for upstream oil and

gas activities in Russia. The analysis touches on a number of critical themes:

- Increasingly large subsidies to Arctic oil and gas production. She notes that all parties recognize this production would not occur without subsidies. Given the extremely fragile ecosystems in this part of the world, and the difficulty recovering from spills, subsidizing extraction there seem particularly foolish. There is, however, lots of money at stake, and it is not just Russia that is rushing in to get in to stake their claims on Arctic resources.

- Sovereign credit, sovereign control. Federal credit support for a variety of energy projects is quite common, often at very high levels ($3-8 billion per project -- see p. 74). Sovereign credit is even more common in the thermal power sector than oil and gas due to reduced access to capital markets. The study notes that there is insufficient data on lending rates and risks to assess the subsidy value of this support. Since oil and gas firms can borrow on global capital markets, the author believes that a core purpose of subsidized sovereign credits in that sector is to reduce the risk of a foreign takeover of the firms should they hit a period of financial distress. Working through the role of federal credit on this infrastructure in more detail would be a very useful piece of follow-on research.

- Lax enforcement of environmental regulations. Even when there are statutes in place, they are rarely enforced. Russia is not alone in this regard; however, it is nice to see the issue picked up explicitly in a subsidy review. Unlike tracking environmental externalities, these are situations where existing law already assigns responsibility to the producing or transporting firm. Lax enforcement means that the cost of paying for damages ends borne by taxpayers or the parties affected by the pollution, rather than in the delivered price of the fossil fuel.

- Property tax exemptions and below-market tariffs for pipelines. With a capital cost in the billions, it is hard to argue that pipelines are not valuable property. Clearly they should pay property taxes where such charges are levied on other industries. Exemptions in Russia are widespread at both the federal and municipal levels, according to Gerasimchuk's review, with a subsidy value of about $2 billion per year. This is more evidence that the subsidies particular industries get are fairly consistent across the world. The controversial Keystone XL pipeline in the US, slated to move tar sands from Canada to Texas, is also receiving significant property tax abatements from the states it crosses. Another interesting element of Russian policy is the decision to subsidize oil exports to China by instituting artificially low tariffs on shipments through the East Siberia - Pacific Ocean pipeline (p. 103). The subsidy was worth an estimated $1.1 billion in 2010.

- Tax evasion through the use of transfer pricing. Multinational firms can buy and sell goods and services to particular divisions at prices set to transfer the accounting profits to low-tax regions or to eliminate taxable income entirely. Past efforts to curb the practice through legislation were of limited success. An additional tightening of regulations is set to occur in 2012, but its success is also not yet proven. The subsidies to the oil and gas sector in Russia are estimated in the billions of dollars per year. My expectation is that better data would find tax avoidance significantly higher than people had expected.

- Special terms in production sharing agreements and widespread municipal tax breaks for, and ownership of, energy-related enterprises. These two important areas are discussed as well, with estimates where possible. Additional research to quantify what are likely widespread subsidies at the municipal levels would be extremely useful.

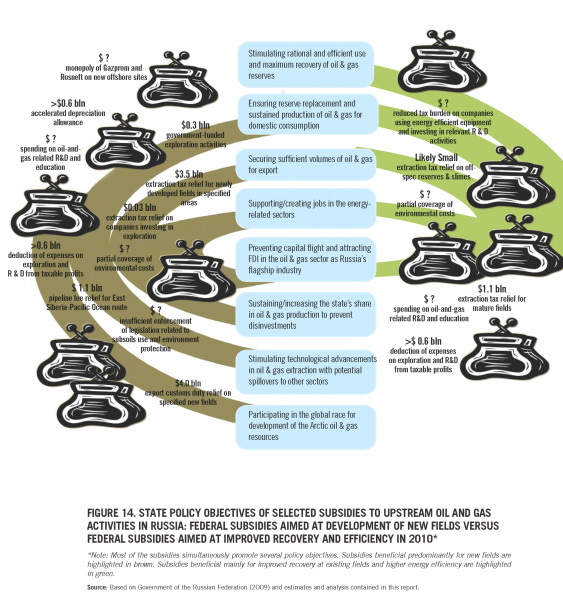

The chart below links many of the core subsidies identified to stated objectives of the policies, and compares support for extending production from mature fields versus subsidizing new ones. The objectives (shown in blue in the center) should be taken as directional rather than definitive. Politics and money are both at play as well, and often tip policies towards those with power rather than towards those most likely to achieve stated social policy goals.