As government interventions in US energy markets grow by leaps and bounds, some of the core principles that made the US an economic superpower are being forgotten. These include using price signals to guide allocation of capital; aligning incentives such that promoters have enough "skin" in the game to weed out unproductive business plans and establish venture discipline in potentially viable ones; and focusing the role of government on establishing market-neutral rules of operations instead of trying to substitute government workers or appointees for entrepreneurs. There is much hype about public-private partnerships. But large scale public funding can actually worsen the situation if the public role is capital allocation rather than market-neutral policy; and if political pressure to cut side deals marginalizes the smaller, less powerful, but perhaps highly innovative market players.

Natural resource subsidies provide a useful window into the ways that government interventions distort economic activities. Logically, if you care about energy policy you should look at energy subsidies. It is not always easy to focus so narrowly, as subsidies to other natural resources or production inputs often influence energy markets in important ways. Agricultural subsidies, for example, play a central role in biofuels economics. Ethanol production in Nebraska, a particularly eggregious example perhaps, is a subsidy triple play, stacking public subsidy not only to biofuels but to water and corn as well. This subsidy virtuouso certainly drives economic activity, though not in a good direction: the region is stripping the Ogallala aquifer at a pace far faster than its recharge, undermining the viability of future generations on the land. The state (with federal help, of course) is basically subsidizing the export of its water.

Large subsidies to transport provide direct support to the movement of bulk energy commodities like petroleum and coal (comprising more than half the tonnage moved on the US inland waterway system); and underpricing of road networks themselves helps boost demand for oil. Linkages across sectors are common. The more extensively inputs are subsidized, the more distorted the resultant economic patterns, and the greater the risk of foolish natural resource consumption.

Water is not free

Water is a useful example. Too often, the economic value of water is ignored in these systems, treated instead as a free good (or nearly so) in the production of all sorts of commodities. (A useful introduction to some of the issues with irrigation subsidies can be found here). In many parts of the US, only withdrawals from municipal delivery systems pay anything for water -- and even here prices are usually based on the break-even revenues for the services provided rather than actual scarcity. Shift to direct tapping of groundwater or withdrawals from surrounding lakes or rivers, and consumption merely requires a permit. Industrial users normally face no actual charges for the billions of gallons of water used, or for the ecosystem degradation that results.

The New York Times had an interesting article a few weeks back on the central role water plays even in alternative energy sources such as solar thermal. The arid environment most suitable for solar gain is also one usually short on water, and it turns out the surrounding communities aren't very happy to see a big chunk of their water supply going to these plants. The point here is not to single out solar power: nearly 40% of freshwater consumption in the country supports thermoelectric power plant cooling, and solar thermal is a small scale new arrival. The decades of subsidized water have benifitted primarily coal and nuclear generation -- driven not only by many large plants, but also by the relatively high water intensity per MWh of delivered power of their respective fuel chains (see charts below from the US DOE).

Water Intensity of Thermal Power Highlights Importance of Withdrawal Fees

Governments seek to mask problems rather than price them

Free cooling water is merely one example of a much broader challenge: what to do when a particular energy resource runs into cost-increasing or growth-constraining limitations. Whether it is mining deaths and black lung from coal production; radioactive wastes, accident risks, and proliferation conduits in nuclear power; or bat kills at windmills, every fuel chain has both benefits and problems. They differ in point and scale of impact, and options (and costs) to control. Choosing the most appropriate energy paths requires making trade-offs amongst these options.

Too often, the government approach is to subsidize away the problems in a misguided attempt to get the specific resources "over the hump" to self-sufficiency. If all resources have some problems, politicians argue, we need to support all potential options to deal with our energy and climate challenges. This approach is flawed in three main respects:

- First, the resultant subsidies are granted using a heavily politicized legislative process to determine eligibility and allocation of benefits -- a process unlikely to achieve economically-rational outcomes.

- Second, whenever handouts prop up one form of energy, they disadvantage other market participants that may rely on the same inputs or that offer lower impact substitutes for the subsidized power. Subsidies to waste fats for use in biodiesel, for example, caused great harm to prior users of those materials in the soap and detergents industry.

- Third, the subsidy approach implicitly assumes that Congress is the best-placed entity to judge the most appropriate solutions to complex problems in a rapidly changing world; and that government bureaucracies are the most appropriate mechanisms to implement or oversee those changes. This didn't work in the former Soviet Union, and I submit it has not (and will not) work here.

What the government should be doing is the exact opposite of its current policy directions -- not picking market winners, but instead forcing the incremental costs of these issues through to market prices whenever it is possible to do so. This creates a strong impetus for change, but in a far more neutral and dynamic manner. This is important because the trade-offs between resources are continually changing -- based on technical shifts, cost of capital, demand conditions, and innovations in business models (such as leased PV panels) to deliver particular resources. True: prices can't do everything. But one of their great strengths is to provide a unified way to make tradeoffs in complex systems, and to do so unaffected by the size of political contributions in the last election cycle, or the personal beliefs of particular lawmakers on the best path forward.

Rather than absorbing commercial liability for nuclear accidents, or long-term performance risks of carbon capture and sequestration projects, federal policy should instead be working to shift these real costs into real market prices for real people to react to. These costs should be moved from taxpayers on to the firms involved, and ultimately borne by the consumers of the goods and services these producers make.

Concerned about climate change? Constrain greenhouse gas emissions in a neutral way, and allow the best substitutes to win rather then granting billions in subsidies by political fiat. Will low carbon energy resources like nuclear be better off? Sure; that's the point. But nukes have other disadvantages that erode their competitive position, and the ultimate winner is not at all clear in advance. The point of neutral policy rather than ever-larger earmarked subsidies is that nuclear plants (or coal with CCS, or solar thermal) will need to prove themselves competitively. This is something they will not need to do if each political constituency is simply granted federal loan guarantees for their plants under Title XVII of the Energy Policy Act of 2005, and the pending Clean Energy Deployment Administration (CEDA) legislation.

Congress is moving to become perhaps the largest source of financing of energy infrastructure in the nation with little squawking even from the supposed fiscal conservatives on the Republican side of the aisle. Not only should Republicans be upset, but they should be joined by the Democrats as well.

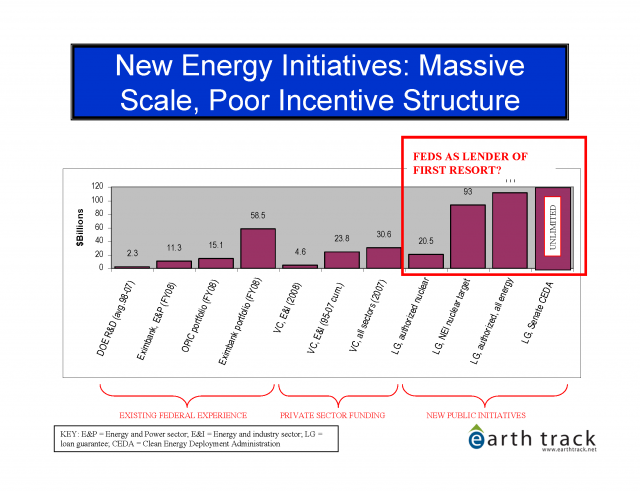

New energy finance initiatives: unprecedented scale, political shifting of financial risks

These funding programs should be a very big deal, subject to much greater scrutiny and skepticism than they have yet received. The CBO went out on a limb in its recent scoring of the loan guarantees to note that the government premiums charged to borrowers will "on average, be at least 1 percent lower than the likely cost of the guarantees." Had they said there was no residual cost of the guarantees, CEDA authority to issue loan guarantees, at least in the short-term, would have been virtually unlimited. Yet in subsequent conversations I had with CBO staff, they acknowledged that loss rates could well be much higher than 1 percent. Why not run scenarios showing a range of plausible losses rather than pegging the scores at only 1 percent loss? I asked. Their response: for general scoring they must come up with a point estimate. If specifically requested by a member of Congress to run a Monte Carlo simulation or similar analysis to generate a more realistic range of expected losses from the program they could do so. Perhaps a member of Congress should ask them to do just this.

These types of gaps in review are unconscionable given the scale of this program. The level of credit support, even without additional scale-ups that are likely under CEDA legislation, is equivalent to roughly forty years worth of DOE investment in energy research and development based on current funding levels. The program is roughly three times the 2007 funding level of the US venture capital industry to all sectors, not just energy. And outside of the internet bubble, 2007 was a peak year in what is the largest venture capital market in the world.

We should be very worried about how this program will scale efficiently, and what less politically-connected ideas and approaches will be starved of funding or market access as a result.

Unfortunately, the massive scale of this effort to socialize our investments into core energy infrastructure is compounded by a poor incentive structure. Under the current rules, the feds cover up to 80% of the project's total cost, and can guarantee the full amount of the project debt. A single loan guarantee to a new nuclear power plant will exceed the value of entire bailout of Chrysler in 1979 (yes, even adjusted to current dollars), though with none of the upside gains that the Chrysler deal contained in stock warrants.

Guarantees on the order of hundreds of billions of dollars are under discussion. In response to questions on his Congressional testimony in March 2009, Marvin Fertel of the Nuclear Energy Institute, the industry's main lobbying arm, pushed for initial guarantees to the nuclear reactor sector alone approaching $100 billion (Fertel testimony begins at about the 88 minute mark).

Despite the tremendous complexity of our climate change challenges, there are many possible ways to meet them varying in cost, scale, and time of delivery. It is arrogant to assume we know the best ways in advance. Instead, we should recognize that we need a wide array of well-structured contenders, knowing that many approaches that seem promising now will ultimately fail. Our current approach to put increasingly large bets on a few horses is a foolish one. Its chance of success is further diminished by slating the government to allocate the capital, in the process choosing the winners of this all important energy contest.

The track record here is not good. Yet, based on the current proposed structure of CEDA (starts Section 101 of the bill), the capital deployment decisions will be made by a small cadre of government officials with limited oversight by the mostly politically-selected Advisory and Board members. Efforts to force funding diversification by capping the share of guarantees to any one technology at 30% of the pool -- constraints common in the majority of mutual funds in which we invest for our own future earning -- is being resisted by sectors such as nuclear that want the ability to get even more.

The premise that the pending credit programs are no big deal and are similar to what the country already does in the US export credit agencies (Eximbank and OPIC) is wrong. Based on analysis I did for a forthcoming report on subsidies to nuclear power in the US, the advanced energy lending commitments will be much larger and more concentrated than these other programs. Project funding levels in the export credit agencies, and even within energy-related venture capital, are normally well below $50 million each. Single-project commitments under Title XVII and CEDA will regularly be in the billions -- roughly two orders of magnitude higher. The alignment of interests between the federal gatekeepers on this new pot of money and the long-term performance of the ventures they are funding is virtually nil.

The advanced energy loan guarantee program has been derisively referred to as "next synfuels program," in reference to the government's disastrous investments (initiated by the Carter administration), to convert coal into synthetic liquid fuels. Given the massive size and poor incentive alignment in the existing program, losing as much as we did on synfuels may ironically turn out to be the best-case scenario.