Natural gas fracking well in Louisiana, (c) 2013 Daniel Foster

Vetting the incentive alignment in large scale federal energy lending programs

I've just posted the slides from a presentation I gave at the New America Foundation in December. The discussion provides some additional detail on why I am so critical of the Obama administration's push for massive loan guarantees to energy facilities.

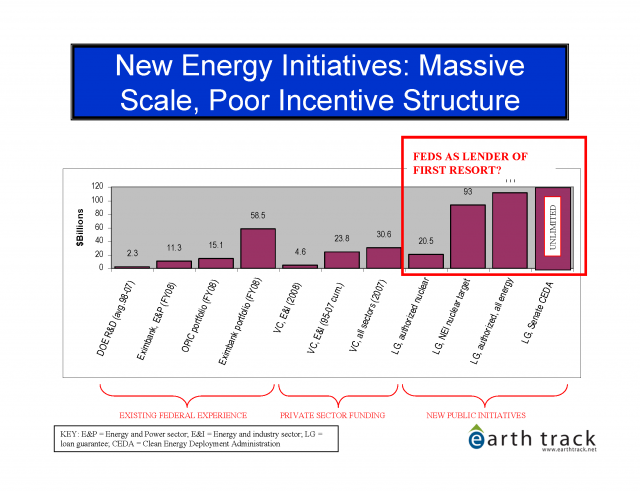

There are three main issues here. The first, as illustrated in the chart reproduced below, the scale of lending is far larger than other similar programs the federal government has undertaken in the past. Title XVII of the Energy Policy Act of 2005, in combination with stimulus spending, is now well over $100 billion in authorized credit support. The Clean Energy Deployment Administration (CEDA) -- thankfully still only a proposed law -- could be even larger. The idea that experience from existing export credit agencies or subsidized loans to rural energy facilities can serve as a sound model for running these much larger programs is, in my view, misguided. Steps to boost review, staff skills, and incentive alignment appropriate for a program of this scale do not seem to have been taken. In fact, the information I've received from people more closely linked than I to the agencies involved with assessing the risks of the loan guarantees indicates that political pressure to minimize the estimates of financial risk (and hence any required credit subsidy prepayments) continue unabated.

The second important issue is that the lending programs are focused primarily on energy technlogy development, with the mistaken assumption that if you build it, they will come. Yet, experts such as Innosight, LLC (Clayton Christensen's firm) that focus on disruptive transformation of industries, identify the technology as only one of four key attributes needed for success (see slide 4). In fact, when a political process drives capital allocation, the most heavily funded groups tend to be the most politically powerful, not the sectors most able to deliver carbon reductions at low cost (slide 5).

Finally, the presentation identifies a number of key program attributes that are likely to contribute to a higher or a lower chance of success. When the CEDA program is evaluated against these criteria (slides 6-8), the deficits in program structure and control become all too evident.