A big success at the last Conference of Parties for the Convention on Biodiversity (COP15) nearly two years was passage of the Kunming-Montreal Global Biodiversity Framework (GBF) to protect and restore nature. The GBF included Target 18, the first quantitative reduction goal for environmentally harmful subsidies (EHS), which commits to reduce EHS by $500 billion annually by 2030. Not long after, the Biodiversity Beyond National Jurisdiction (BBNJ) Agreement, or the “High Seas Treaty” also passed. It now has more than 90 signatories (though far fewer ratifications), and will establish a legally binding instrument to conserve and sustainably manage marine biodiversity in areas beyond national jurisdiction, an area that encompasses roughly two-thirds of the world’s oceans.

With COP16 coming up in just over a month, and the 2025 reporting deadlines on EHS under Target 18 fast approaching, revisiting the state of EHS seemed both timely and important. The result of that review, "Protecting Nature by Reforming Environmentally Harmful Subsidies: An Update" has been released today. As was the case on the initial study, I've authored the update with Ron Steenblik, my long-time colleague on many subsidy-related issues. We are again grateful to Business for Nature and Greenhouse Communications for their help in amplifying the key messages, Spiral Communications for their graphic design of the report, and the Society of Entrepreneurs and Ecology (SEE) and Shell Lin for the Mandarin translation of the Update.

A critical aspect of our initial review in February of 2022 was the inclusion multiple economic sectors affecting resource extraction and land-use change. It is the combined effect of subsidies to these sectors that compound to drive loss of nature and biodiversity resources. International analysis of subsidies has too often focused on a single sector, which risks underestimating the subsidy-related distortions affecting resource use patterns in specific locations.

English Version of EHS Update Chinese Version of EHS Update

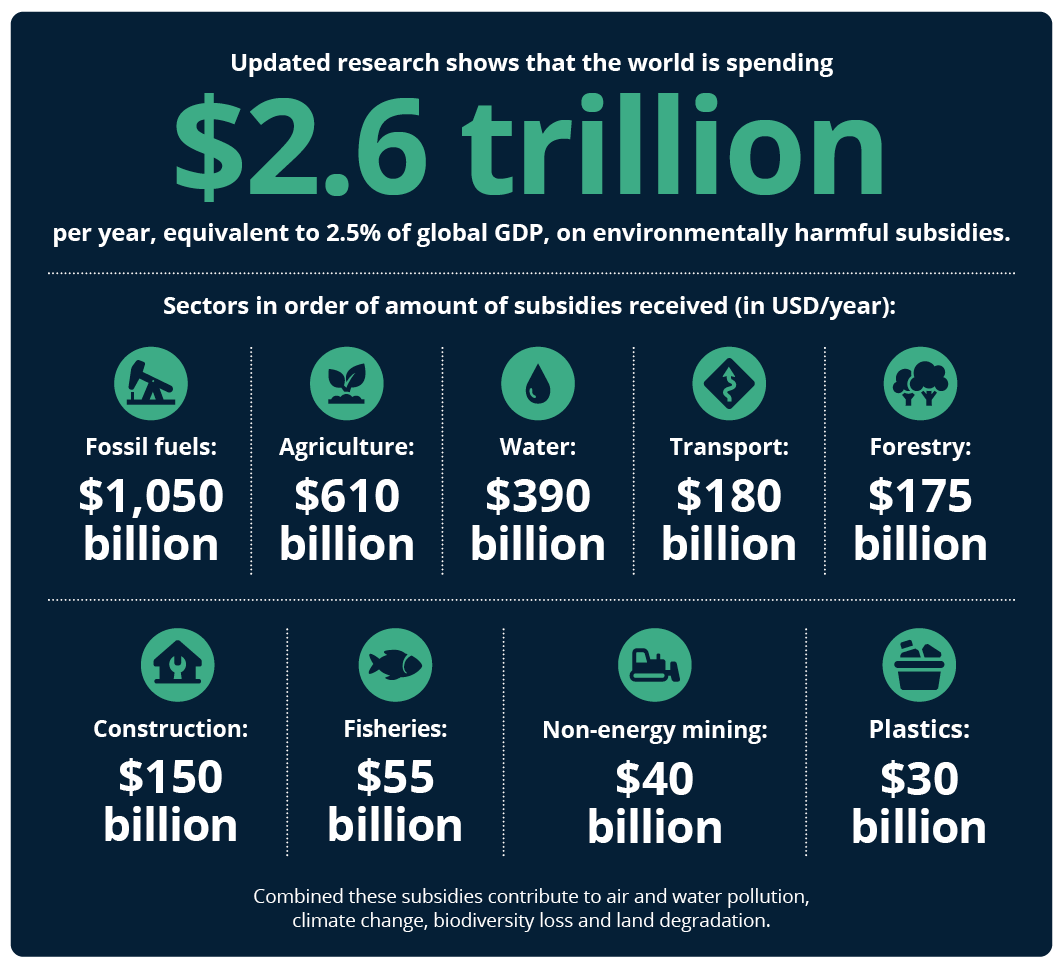

EHS are at least $2.6 trillion, equivalent to 2.5% of global GDP

Even with the GBF and associated increased focus on EHS, the scale of subsidies continues to rise. Our current estimate is at least $2.6 trillion a year, equivalent to 2.5% of global GDP. These subsidies harm nature and associated biodiversity, and slow global efforts to transition to lower-impact production methods and energy systems. We continue to view our estimate as a floor value for EHS because we know there are so many large data gaps. Closing the largest of these should be a priority for signatories working on Target 18 compliance.

Our updated EHS estimate is about $800 billion higher than two years ago, or roughly $570 billion higher net of inflation. A combination of improved data -- including estimates for non-energy mining and plastics production for the first time, inflation, and rising subsidies particularly to fossil fuels was behind the increase. It is also worth noting that the $500 billion reduction commitment by 2030 under Target 18 is not indexed for inflation and will have declining purchasing power as the years go on.

As in 2022, the largest EHS subsidies remain those supporting fossil fuels, agriculture, and water. Fossil fuel subsidies (FFS) are the primary driver of the increased totals. FFS surged to more than $1.5 trillion by the end of 2022 as the Russian invasion of Ukraine led governments around the world to attempt to buffer consumers from price increases. Although FFS dropped to more standard levels in 2023, the volatility highlights the sensitivity of EHS levels to macroeconomic shocks. Policy structures to prevent backsliding on EHS need to be incorporated into compliance with Target 18. Further, subsidies to carbon capture are growing rapidly in many countries, and are particularly generous in the United States. Much of this will support core fossil fuel industries, including through enhanced oil recovery, and the economic incentives to keep older high-carbon infrastructure in service longer and operating at higher capacity factors. At least in the US, CCS subsidies could exceed all other producer subsidies to the sector combined by 2030 or soon after.

Subsidies to agriculture also increased sharply to bolster food security following the Russian invasion of Ukraine, though these are not considered EHS. EHS within agriculture were largely flat net of inflation, though subsidies to biofuels seem to be growing and remain inadequately quantified globally. Often the feedstocks for these fuels are resource-intensive monocultures, and scaling production has contributed to habitat loss in the past.

Subsidies to fisheries, forestry, and water are little changed net of inflation in the update, the result of continuing large data gaps rather than a stable policy environment. Indeed, analytic work combining remote sensing of key fisheries with AI processing of images suggest that illegal fishing may be greatly undercounted. Similarly, consumption by agriculture and industry continue to comprise more than 85 percent of global freshwater consumption, most of which comes via direct withdrawals from aquifers and surface water. However, data on the economics of these transactions, including what, if any prices are paid, were almost entirely lacking.

Although subsidies to both transport and construction remain mostly placeholders because of known gaps in our information, we were able to incorporate policy updates and some additional analysis of subsidies to housing construction within the EU and improve coverage of subsidies to maritime transport. User fees on core road and rail infrastructure globally appear to lag system costs by a large amount, possibly hundreds of billions of USD annually.

The update includes an estimate to non-energy mining for the first time, though the value is also more a placeholder than global estimate. Rising subsidies to minerals used for EVs and other decarbonization technologies are evident in media articles but are not tabulated globally. Subsidies to plastics industries have also been added as a category of EHS owing to rising international attention on plastics and plastics pollution. Work to quantify plastics subsidies for the first time was done by a team that included Ron Steenblik.

The graphic below provides a breakout of our updated estimates by sector.

Estimated EHS by Sector

Progress on Target 18

Initial work on Target 18 has focused on reporting mechanisms, data sources, and early measurement challenges. Reviews have either been conducted or are in process by a number of countries, and regionally by the EU. Helpfully, many of these proposed identification and estimation methods aim to measure not only policies within their country, but also to highlight any significant EHS affecting commodity imports from countries with critical habitat and biodiversity risks.

Two baseline measures are being used. Target 18.1 focuses on positive incentives to promote biodiversity protection and sustainability, and Target 18.2 aims to track the value of EHS and other incentives harmful to biodiversity that have been eliminated, phased out, or otherwise reformed.

Progress on Target 18.1 has been moving faster, reliant on data already tabulated by OECD. However, policy details focus mostly on the number of measures rather than a more rigorous evaluation of their scale and impact. On EHS reforms, existing data sets are also being tapped, though coverage varies widely by sector, and in all areas the data capture only a portion of the subsidy types.

Building a comprehensive baseline set of EHS under Target 18 is implied but not formally committed to in the current efforts. It will be necessary. New EHS are continually created, so measuring only removals would miss important trends. Similarly, if tracking is limited to the simpler subsidy mechanisms such as direct spending and reductions in fuel taxes, political pressures will likely shift government support to more complicated mechanisms that are far less visible. These include credit or insurance subsidies, below-market minerals leasing, or targeted exemptions to regulatory rules.

We expect that measurement and reporting will need to improve iteratively since both data availability and measurement techniques vary widely by country and type of support. Further, disagreements across GBF signatories on how to evaluate policies with some positive and some negative impacts on nature are expected to be common. The reporting framework should be a high-ambition effort, not lowest common denominator, even if reporting progresses unevenly across signatories. Technically-focused workgroups are common for establishing financial reporting and technical standards, and that approach could be adopted to standardize measurement and reporting of specific types of subsidy instruments.

Multiple paths of action needed to contain EHS

Target 18 establishes a multi-sector tracking system for EHS. Other prior international agreements in fisheries, agriculture, and fossil fuels have had similar goals, despite being more narrowly targeted. These initiatives, summarized in the Update, have faced some common challenges, such as difficulty in getting sufficient ratifiers to bring the agreements into force; spotty or inconsistent reporting; inadequately funded secretariats; disincentives for "first movers" to fully engage with the reporting process; and limited or no enforcement powers against non-compliers.

These challenges mean that Target 18 should be one, but not the only path to address EHS; and that people should think creatively about how to leverage the opportunity that Target 18 offers. For example, in addition to informing actions by others, the data within the EHS tracking system should be supplemented by information those outside may have. Independent parties such as civil service organizations or those harmed by existing subsidies often have relevant and sometimes obscure data. They should be able to report missing or inaccurate data about signatory countries, possibly anonymously, into the Target 18 system. In addition to collecting raw data on subsidies, it is also important to get better at measuring trade-offs (subsidies that harm nature may also create jobs or alleviate poverty, for example), and identifying ways to achieve these same social goals more efficiently and without the environmental down-sides.

Engagement by business remains critical in addressing EHS. Some businesses are harmed by subsidized producers in other countries, so have an obvious interest in reform. Others may see a potential business opportunity either in tracking subsidies or related activities, or in developing new products to help address the unmet needs. New insurance products might be an example; given rising risks to the built environment from severe events often linked to climate change, the current path has been to provide more government subsidy. But innovation in better ways to predict, offset, share and spread risk could reduce the gaps here that are more financially and environmentally sustainable over the long-term.

New innovation often starts with a niche idea, pursued by a small group of people who see benefits others don't, or face pressures others don't. In the beginning, they are too small for anybody to care about; but if they are successful, sometimes the systems, software, and products they build change the way everybody else works and interacts with the world.

The logic and opportunity for business success was addressed in more detail in our 2022 report; the recommendations remain as valid now as they were then. I wrote then that new innovation often starts with a niche idea, pursued by a small group of people who see benefits others don't, or face pressures others don't. In the beginning, they are too small for anybody to care about; but if they are successful, sometimes the systems, software, and products they build change the way everybody else works and interacts with the world. A big advantage of business engagement is that across many areas of concern firms can operate and innovate individually or in small groups. And while international agreement can set important parameters for market activity and innovation, the parties often move slowly. Businesses can move much faster.

We had hoped to see many seeds of this type of innovation start to grow over the past two years, and invite you to share any you have seen. Some of the most interesting and powerful examples highlighted in this update are from the marriage of satellite imaging and machine learning -- though often blending a mix of private firms, governments, and universities. The potential here to change what is possible in managing forests, mining operations, and fisheries seems enormous. The ability to identify and monitor emissions in this way is growing as well. So there is reason to be hopeful.

Related Resources

Earth Track 2024 report on EHS - English version - Mandarin version

Earth Track 2022 report on EHS - English version - Mandarin Version

Business for Nature's EHS Reform webpage and reform action briefs "Financing Our Survival - 2024 Update - 2022 Original

EHS reform video from 2022

Convention on Biological Diversity COP16 web page.